A Quiet Moment After the Fork

The holiday break creates a rare kind of space. Space away from delivery timelines, governance calls, and the constant pull of near-term decisions. It is often in that pause that older questions resurface, the ones that never fully go away, but are easy to defer when momentum is high.

For me, that meant thinking again about Web3, decentralization, and governance. Not as slogans or abstractions; web3 as systems that real organizations eventually have to operate within.

Those thoughts naturally returned to Ethereum Classic. After the fork, once the network stabilized and attention shifted from execution to continuity, one of the first questions to emerge was not technical at all. It was structural.

How do we decide how to decide?

This question has appeared repeatedly throughout the history of decentralized systems. It surfaced early in Ethereum’s research phase as well, where governance and coordination were debated openly long before formal mechanisms existed. One such discussion I think about, preserved in Ethereum’s public research history, explored incentive-aligned decision-making in decentralized environments and remains a useful reference point today.

At the time, one approach stood out to me because of how uncompromising it was. It offered no procedural ambiguity and no rhetorical escape hatches. Decisions were explicit. Outcomes were enforced. Being right mattered, and being wrong had consequences.

It had a certain clarity to it. Almost a “victory or death” mindset.

That approach was futarchy.

Futarchy as an Idea That Refused to Go Away

Futarchy was originally proposed by economist Robin Hanson as a governance model built around outcomes rather than opinions. His framing was simple and unsettling: communities should agree on what they value, and allow markets to determine which actions are most likely to achieve those values. Hanson’s essay “Shall We Vote on Values, But Bet on Beliefs?” remains one of the clearest articulations of the idea.

The concept later found an audience in the blockchain world, where governance was already an open problem. In Ethereum’s early days, futarchy was discussed as a serious alternative to informal social consensus and simple token voting. Vitalik Buterin explored this explicitly in early Ethereum governance writings, describing futarchy as one of the more rigorous models available at the time.

Even so, futarchy felt premature. Prediction markets were thin. Privacy was difficult. Enforcement mechanisms were brittle. It was easier to admire the idea than to imagine deploying it inside real organizations.

That gap between theory and practice is what makes the present moment different.

Why This Moment Feels Different

What has changed is not the idea of futarchy. It is the mechanics that make it understandable and usable.

At its core, a prediction market is simply a structured way to answer a binary question using capital instead of opinions. The easiest way to understand this is through a familiar analogy.

Consider a championship game between two teams. A market opens with two outcomes: Team A wins or Team B wins. Participants place stablecoin bets on either outcome. As more money flows toward one side, the implied odds shift. The price of each side reflects the crowd’s collective belief about what is most likely to happen.

No one is asked who they want to win. The only signal that matters is where people are willing to put money.

This is powerful because it forces honesty. Participants with better insight or information are incentivized to act. Those without conviction either stay out or lose capital. Over time, the market price becomes a real-time forecast that often outperforms polls, committees, or expert judgment. Decades of research and real-world experimentation support this, including corporate forecasting use cases summarized here: https://www.chicagobooth.edu/review/prediction-markets-explained

Futarchy applies this same mechanism to decisions.

Instead of betting on a sports outcome, participants are asked to bet on whether a decision will lead to better results than an alternative, based on a metric everyone agrees matters. The “teams” are the choices. The “score” is the outcome.

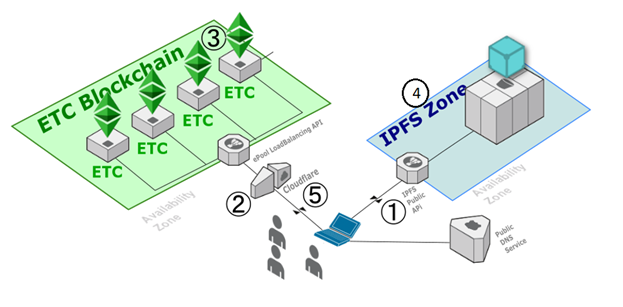

What makes this moment different is that the infrastructure to run these markets cleanly now exists. Stablecoins provide a neutral unit of account. Smart contracts enforce rules and payouts automatically. Private blockchain environments allow participation to be restricted while keeping outcomes auditable.

Privacy has evolved as well. Markets inspired by Dark Forest–style designs show how participants can contribute signals without revealing identity or intent, while still allowing the market itself to remain trustworthy and verifiable.

Together, these advances remove the practical friction that once kept prediction markets and futarchy theoretical.

What follows is a thought experiment, not a product announcement.

ClearPath, as described here, is a fictional future private-market platform used to illustrate how futarchy could work in corporate governance. It does not exist today.

The ideas are real—and increasingly plausible.

A Fictional Example Using ClearPath

Consider a private manufacturing company evaluating whether to open a new factory. The decision involves meaningful risk. It requires a large capital investment and commits the company to long-term operational exposure under uncertain demand.

The process begins by agreeing on what success means. Stakeholders align on a clear, measurable outcome, such as EBITDA growth over the next twenty-four months. That metric is fixed before any decision is evaluated.

ClearPath then opens a single decision market with two possible outcomes: build the factory or do not build the factory.

Participants are invited into a defined decision window, for example thirty to sixty days. During that period, they place stablecoin-backed positions on the outcome they believe will result in better performance on the agreed metric. They are not voting and they are not expressing preferences. They are committing capital based on belief.

As capital accumulates on each side, the market price moves. By the end of the decision window, the price reflects the collective forecast. If the market consistently values the “build” outcome higher than the alternative, the decision is executed. If it does not, the proposal fails.

This is useful because it produces a clear signal without debate. It allows insight from across the organization and investor base to surface without politics. It rewards accuracy over authority. And it creates an auditable record showing not just what decision was made, but how confident the organization was in that decision at the time.

Once the decision is implemented, the market remains open until the evaluation horizon is reached. When the metric is observed, participants who were correct are rewarded, and those who were wrong absorb the cost. Over time, this creates a feedback loop that favors reliable judgment.

This is the core futarchy rule as originally articulated by Robin Hanson: actions should be taken when markets predict they will improve the agreed outcome.

Why This Is Useful for Governance

For private companies, this approach offers something traditional governance struggles to provide.

It separates decision-making from persuasion. It reduces the influence of hierarchy without removing accountability. It creates a mechanism where being right matters more than being convincing.

ClearPath is fictional. But the model it represents is increasingly realistic.

Sometimes the hardest governance question is not what decision to make, but how to make it in a way that is fair, informed, and durable.

Prediction markets offer one answer. Futarchy gives them purpose.

And for organizations willing to think beyond familiar structures, that answer may finally be actionable.

Happy Holidays

Cody & the Burns family